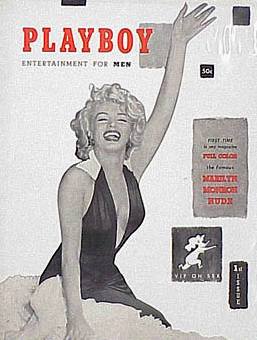

AP – FILE - This Jan. 29, 2008 file photo shows an electronic message board warning those crossing the border …

By MANUEL VALDES, Associated Press Writer – Sat May 30,

BLAINE, Wash. – New rules requiring passports or new high-tech documents to cross the United States' northern and southern borders are taking effect Monday, as some rue the tightening of security and others hail it as long overdue.

The rules are being implemented nearly eight years after the Sept. 11 attacks and long after the 9/11 Commission recommended the changes. They were delayed by complaints from state officials who worried the restrictions would hinder the flow of people and commerce and affect border towns dependent on international crossings.

In 2001 a driver's license and an oral declaration of citizenship were enough to cross the Canadian and Mexican borders; Monday's changes are the last step in a gradual ratcheting up of the rules. Now thousands of Americans are preparing by applying for passports or obtaining special driver's licenses that can also be used to cross the border.

"It's sad," said Steve Saltzman, a 60-year-old dual Canadian-American citizen as he entered the U.S. at the Peace Arch crossing in Blaine, Wash., on Thursday. "This was the longest undefended border in the world. Now all of the sudden it is defended, and not nearly as friendly."

Near the border crossing, local Blaine resident Mike Williams disagreed. "This concept was past due," said Williams. "Because it's not a safe world and it's becoming more dangerous all the time."

In one Texas border community, long lines were reported at a local courthouse as people rushed to apply for the required documents. But it remains to be seen if the new requirement will cause traffic backups at points of entry and headaches for people unaware of the looming change.

U.S. Customs and Border Protection officials say they're confident the transition will be smooth.

"Our research indicates approximately 80 percent of the individuals coming in now, U.S. and Canadians, are compliant," and are crossing with proof of citizenship, said Thomas Winkowski, assistant commissioner for field operations at Customs and Border Protection.

The higher noncompliance areas, he said, are primarily U.S. citizens in the southern border region.

Travelers who do not comply with the new requirements will get a warning and be allowed to enter the U.S. after a background check, said Michele James, director of field operations for the northern border that covers Washington state.

"We're going to be very practical and flexible on June 1 and thereafter," James said.

The new rule, which also affects sea crossings, is the final implementation of the Western Hemisphere Travel Initiative, a security measure crafted from recommendations from the 9/11 Commission.

It's part of a gradual boost in security along the northern border that has featured millions of dollars in upgrades and the hiring of hundreds of more customs officers and U.S. Border Patrol agents.

Before the new rule, travelers only needed to show identification, such as a driver's license, and orally declare their citizenship. In 2008, the federal government changed that rule to require proof of citizenship, such as a birth's certificate or a passport.

Winkowski said people expected delays at points of entry in 2008 after proof of citizenship became a requirement, but no serious backlogs appeared.

He said U.S. Customs and Border Protection will continue its outreach campaign through the summer to inform Americans of the new passport requirement.

Under the new rule, travelers also can use a passport card issued by the U.S. State Department to cross land borders. The card does not work for air travel. At $45 for first-time applicants, it's a more affordable alternative to the traditional passport, which costs $100. More than 1 million passport cards have been issued since last year.

Identification documents available under the "Trusted Traveler" programs are also accepted. Those require fees ranging from $50 to more than $100. These programs, developed by the U.S, Canadian and Mexican governments, allow vetted travelers faster access to the border. In some cases, members in these programs have their own lanes at border crossings.

Enhanced driver's licenses, which use a microchip to store a person's information, also can be used to cross the northern and southern borders. Washington state, Vermont, New York, and Michigan are the only states that offer them so far. An application process and interview are required for these licenses.

There will be some exceptions. Children under 16 traveling with family, people under 19 traveling in youth groups, Native Americans and members of the military will be able to use different forms of identification. Also, travelers in cruises that depart from a U.S. port, sail only within the Western Hemisphere and return the same port do not have to comply.

The U.S. State Department said there has been no spike in passport applications because of the June 1 deadline. The increase came in 2007 when it became required to show a passport for air travel to Canada, Mexico and the Caribbean. That year a backlog of applications accumulated, affecting travelers nationwide.

The number of U.S. passport card applications, however, has increased as June 1 approaches, said Brenda Sprague, head of the passport division of the department's Bureau of Consular Affairs.

For states along the vast northern border, which for decades enjoyed fewer restrictions than the southern border, the changes sparked a wave of opposition when they were first proposed.

Concerns appear to have died down, however. In Washington state, for instance, the governor's office said it was pleased with the federal government's progress.

In the border town of Weslaco, Texas, Jesus Gonzalez said he crosses into Mexico about three times a month for medical needs, but he had not yet applied for any of the documents.

Asked if the new requirement would affect him, Gonzalez pointed back across the bridge toward Nuevo Progreso, Mexico: "It's going to affect them more," he said. "Businesses are going to hurt a tad bit and I feel sorry for them."

__

Associated Press Writers Eileen Sullivan and Matthew Lee in Washington, D.C., and Christopher Sherman inMcAllen, Texas contributed to this report.

Source: http://news.yahoo.com/s/ap/20090530/ap_on_re_us/us_border_crossing_rules